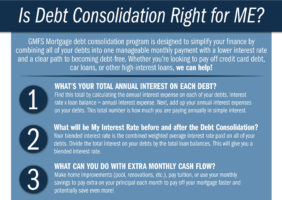

Is a Debt Consolidation Mortgage Right for Me?

GMFS Mortgage debt consolidation program is designed to simplify your finance by combining all of your debts into one manageable monthly payment with a lower interest rate and a clear path to becoming debt-free. Whether you’re looking to pay off…