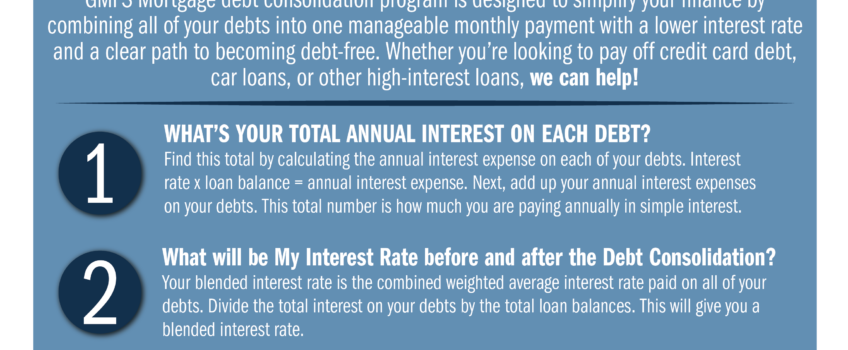

Refinancing for Debt Consolidation

Needing debt consolidation? We can help! As interest rates on cars and credits cards climb, managing your consumer debt can be a challenge. The average rate on existing credit card debt has risen to over 21% just in 2024. That…