How Higher Interest Rates Can Affect Your Buying Power

While mortgage interest rates remain near historic lows, they’ve started creeping up this year. As the economy continues to recover from the effects of the pandemic, experts are predicting that rates could continue to rise. So, what does this mean if you’re planning to buy a home?

Higher Rates May Mean Less Purchasing Power

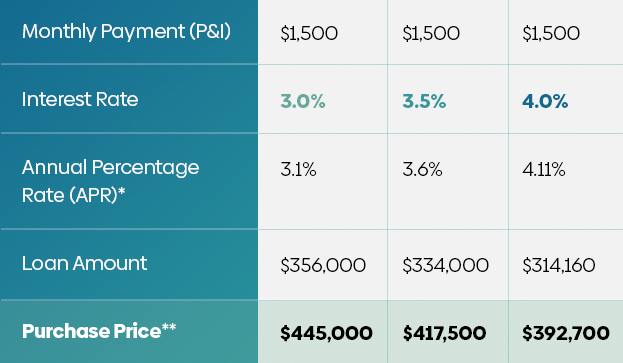

As rates go up, the amount of home you can afford goes down. For every 1% increase in interest rates, your buying power may decrease by about 10%.

Think of what that buying power could translate to — a better neighborhood or school district, a move-in-ready home that requires no renovations, a larger space for your growing family? An increase in rates could limit your options.

Higher Rates = More Money Spent on Interest

A higher interest rate also means you may spend more money on interest over the life of your loan, causing you to pay more for your home in the long run.

Bottom line? If you’re ready to buy a home, don’t wait until rates climb even higher. Get more for your money by locking in a low rate today.