Category

Financial Education

Which Down Payment Assistance Programs Are Available to You?

Down payment assistance can help you buy a home sooner than you think. Connect with GMFS Mortgage to find the best program for your needs.

While a fixed-rate mortgage locks in your interest rate for the life of the loan, an ARM offers an interest rate that adjusts over time.

What Is a Self-Build Construction Loan?

A self-build construction loan is designed for borrowers who want to manage the construction of their new home themselves, rather than hiring a general contractor to handle the entire project. With this type of loan, you work directly with builders and subcontractors, and take responsibility for coordinating and managing the overall process.

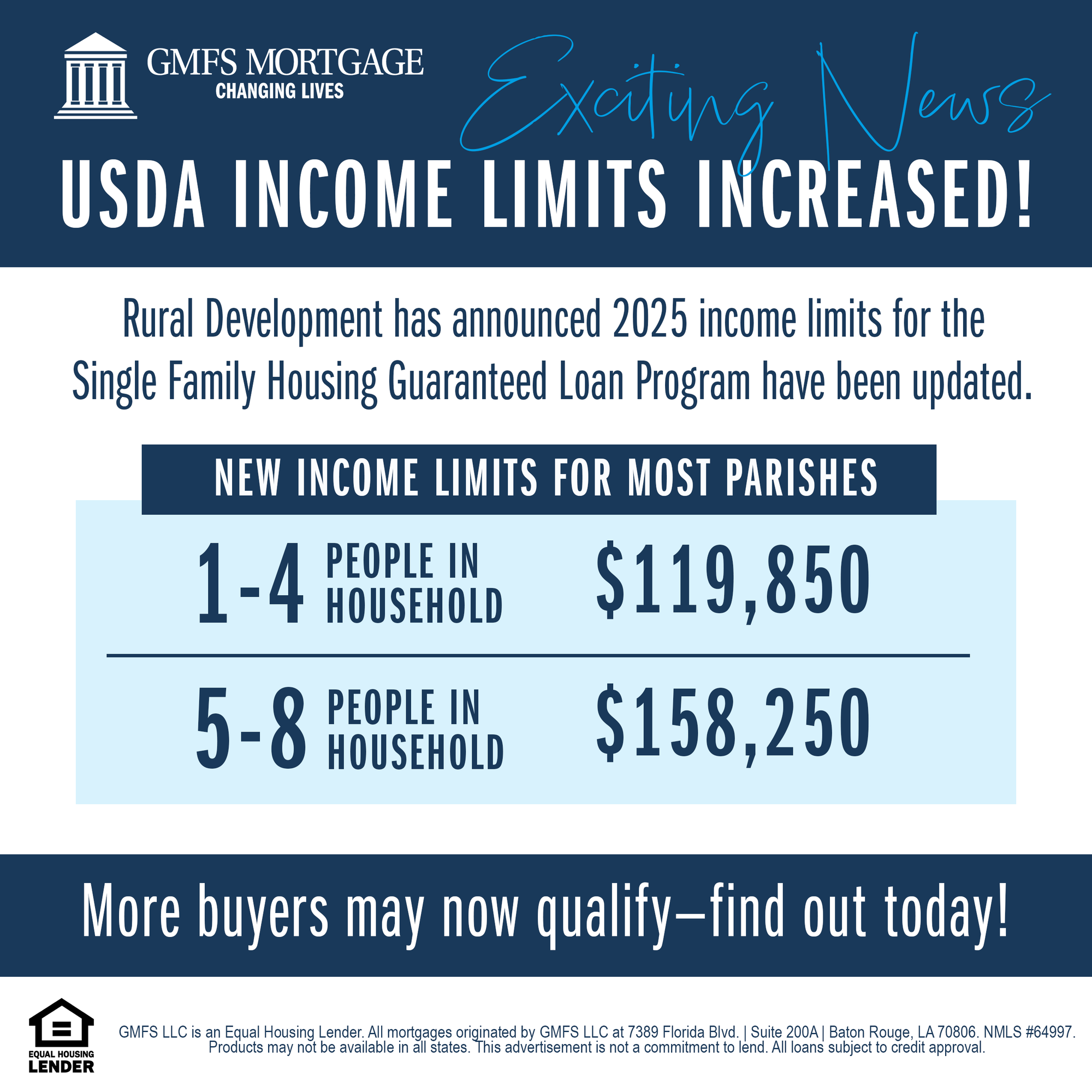

USDA Rural Development Income Limits 2025

USDA Rural Development increased Income Limit for the Single Family Guaranteed Loan Program in 2024. Get pre-qualified today!

Tariffs and the Housing Market

For those ready to make a move, now could be the best time. Locking in today’s prices and interest rates might offer long-term savings.

Building vs. Buying a House in 2025: Which Is Best?

Wondering if it’s cheaper to build or buy a home in 2025? Explore the pros, cons, and financing options for both choices with GMFS Mortgage.

Learn about the role of loan officers in the home-buying process and how they help you secure the right mortgage. Trust GMFS Mortgage for expert guidance!

Close faster with our GMFS Mortgage mobile app!

With less paperwork to deal with, a loan progress tracker and more, we make it easy to close with GMFS Mortgage!

Will Mortgage Rates Go Down in 2025?

Curious if mortgage rates will go down in 2025? GMFS Mortgage explores expert predictions, housing trends, and what this means for homebuyers in Louisiana.