A New Look, Same Commitment: Welcome to the New GMFS

A New Look, Same Commitment: Welcome to the New GMFS

GMFS Mortgage Macon Voted Best Home Mortgage 2025

Which Down Payment Assistance Programs Are Available to You?

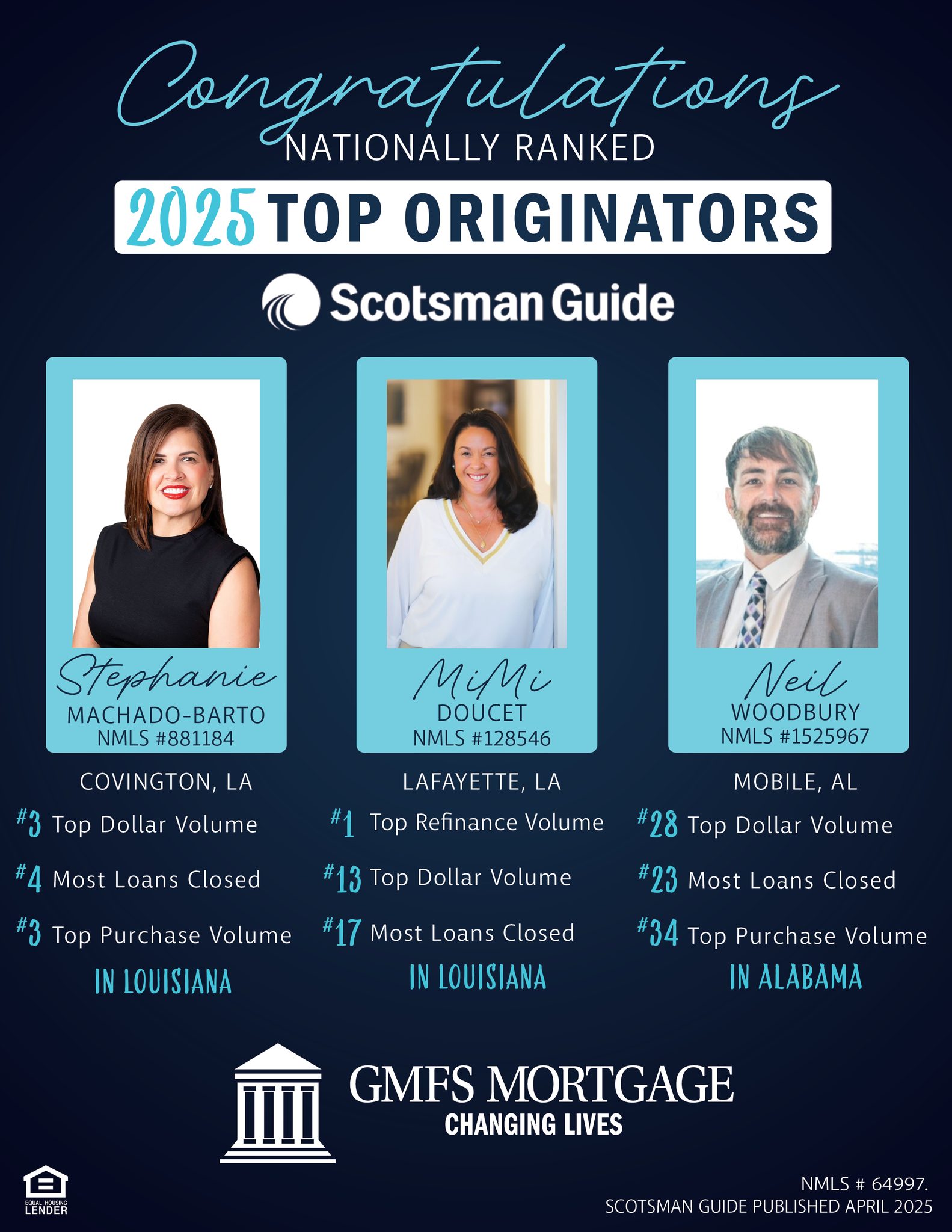

2 GMFS Mortgage Loan Officers named to Scotsman Guide 2025 Top Female Originators List

What Is a Self-Build Construction Loan?

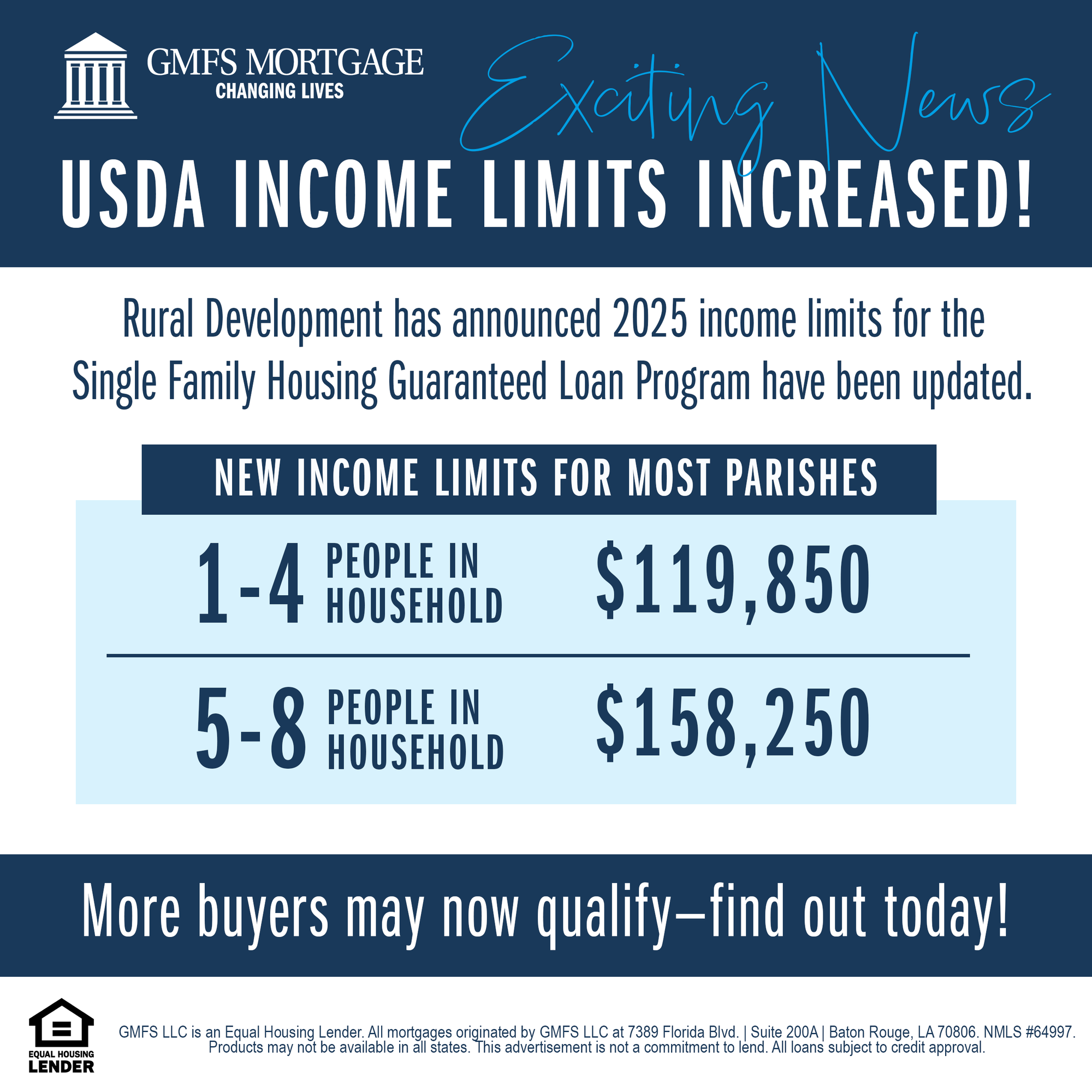

USDA Rural Development Income Limits 2025

Tariffs and the Housing Market