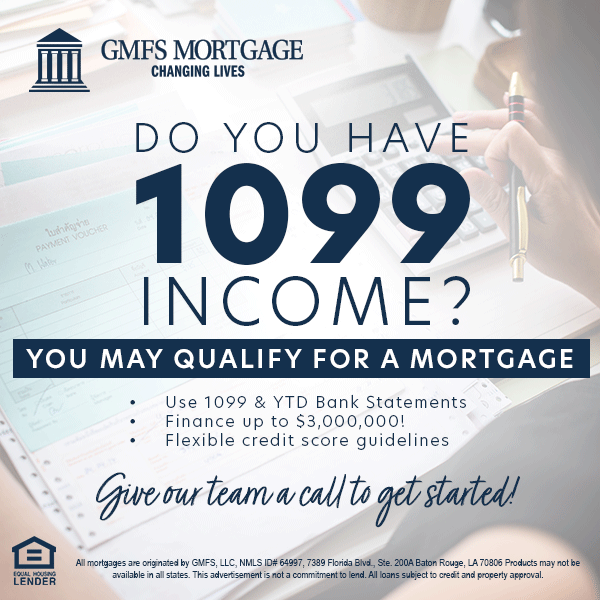

1099 Income Mortgage

New guideline updates are making it easier for self-employed or 1099 income borrowers to get pre-qualified for their dream home!

You may qualify for a mortgage:

- Use 1099 & YTD Bank Statements

- 1099 income eligible in lieu of tax returns

- Finance up to $3,000,000!

- Flexible credit score guidelines

- Prime & Non-prime options

Borrowers must be self employed for a min of 2 years and be with the same employer for 2 years to qualify for this Bank Statement Program.

Contact your local GMFS Mortgage Loan Officer to get pre-qualified today!

*Government loans such as FHA, USDA and VA typically have more flexible guidelines than conventional loans but interest rates are typically higher.

*Not a commitment to lend. All loans subject to credit and property approval. The following terms are for illustrative purposes only. Rates, payments, and loans terms vary by consumer based on their individual qualifying information. The payment amount illustrated does not include the amounts for taxes, property insurance, or mortgage insurance.

| Loan Term | Down Payment | Annual Percentage Rate | Estimated Monthly Payment |

| 30 year fixed rate | 10% (90% LTV) | 4.75% | $1,043 |