News & Media

Mortgage for Energy or Protective Home Improvements

Finance upgrades to reduce utility costs and improve the resilience of your home. This includes energy and/or water. $500 credit at closing

Exciting New Updates for Borrowers

New loan program updates are making it easier for qualified borrowers to purchase their dream home! Talk with a GMFS Mortgage Loan Officer

Smaller Down Payments on Multifamily Homes

Fannie Mae recently announced smaller down payments on multifamily homes! Talk to a GMFS Mortgage Loan Officer today!

Mortgage Interest Rate Deduction

If you're a homeowner that itemizes tax deductions, you can deduct your mortgage interest for qualified residences bought, built or improved

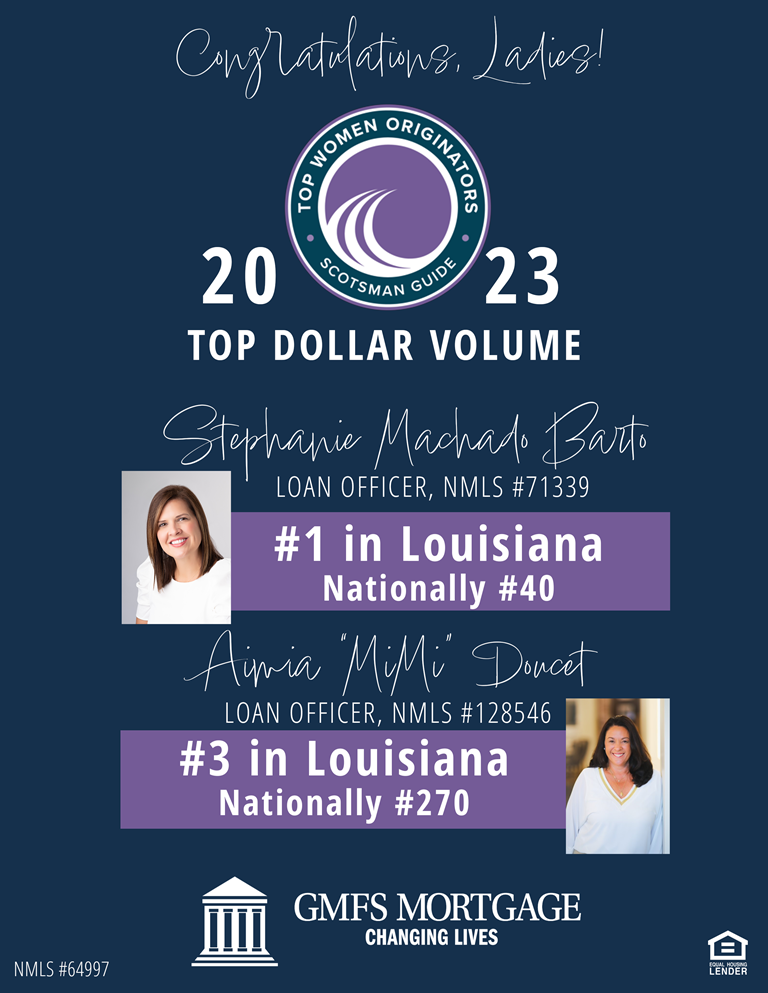

Congratulations to our Loan Officers, Stephanie Machado and Aimia Doucet, for making the Scotsman Guide Top Women Originators 2023 list!

GMFS Mortgage debt consolidation program is designed to simplify your finance and help you become debt-free.

GMFS Mortgage offers flexible home construction and renovation loans that often are less costly than other financing options.

New Carbon Monoxide Detector Law in Louisiana

At least one operable, life-long sealed battery carbon monoxide detector is required when the dwelling is sold, donated or leased.

The cancellation of proposed Debt-to-Income related Loan Level Pricing Adjustments have been dropped by the Federal Housing Finance Agency.

The requirements for bitcoin, cryptocurrency, or coin based assets for home loans include: Must be converted to U.S. currency...

GMFS offers a loan program that can help ease the burden of a higher monthly payment, with help from your builder or independent seller.

The homestead exemption is a wonderful benefit. Consult with an accountant or tax professional for specific tax relief information.