Category

Refinance

While a fixed-rate mortgage locks in your interest rate for the life of the loan, an ARM offers an interest rate that adjusts over time.

Refinancing for Debt Consolidation

Depending on your financial situation, consolidating debt using your home equity could be a beneficial choice for you.

Does it still benefit to Refinance?

Considering refinancing your mortgage in Louisiana? Explore the benefits with GMFS Mortgage to see if it’s the right move for you.

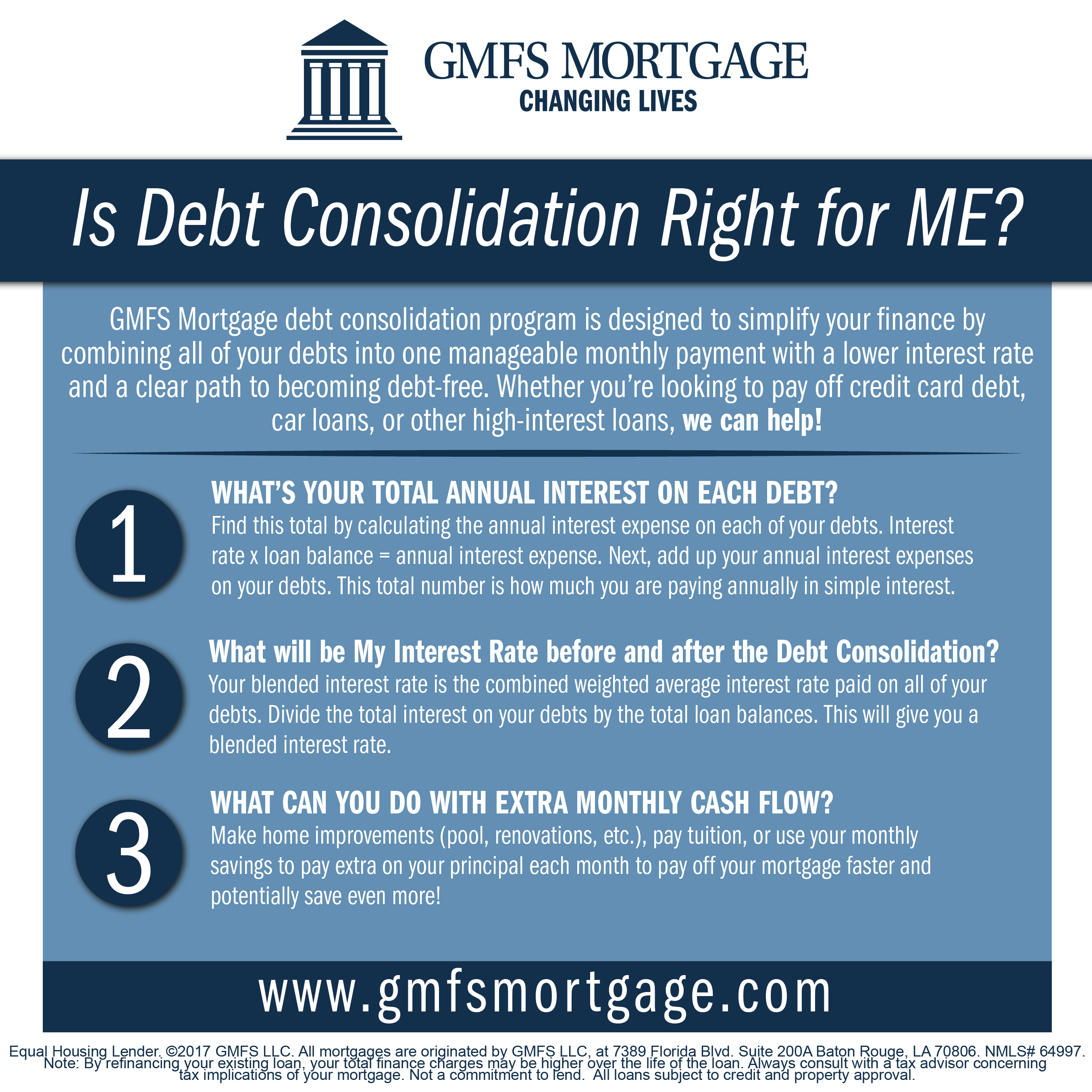

Is a Debt Consolidation Mortgage Right for Me?

Our debt consolidation program is designed to simplify your finance by combining all of your debts into a manageable monthly payment

GMFS Mortgage debt consolidation program is designed to simplify your finance and help you become debt-free.

Refinancing could mean big savings. Refinancing a mortgage means paying off your existing home loan and replacing it with a new one.

What Rising Interest Rates May Mean For You

If you are planning a home purchase or any type of refinancing, like cash from home equity, it may pay to act before further increases.

Is now a good time to refinance?

Pent up equity positions can lead to significant cash flow improvements and/or funds available for significant household purchases

Cash-Out Refinance is when you use your home’s equity to refinance for more than the outstanding balance owed on your current mortgage.

It's a new year, take a mortgage holiday in 2022! Close in January and take a two (2) month payment holiday