Category

First Time Home Buyer

Which Down Payment Assistance Programs Are Available to You?

Down payment assistance can help you buy a home sooner than you think. Connect with GMFS Mortgage to find the best program for your needs.

While a fixed-rate mortgage locks in your interest rate for the life of the loan, an ARM offers an interest rate that adjusts over time.

Learn about the role of loan officers in the home-buying process and how they help you secure the right mortgage. Trust GMFS Mortgage for expert guidance!

Will Mortgage Rates Go Down in 2025?

Curious if mortgage rates will go down in 2025? GMFS Mortgage explores expert predictions, housing trends, and what this means for homebuyers in Louisiana.

The new base loan limit in most areas of the country will be $806,500. Talk to our team today to see how new loan limits could benefit you!

Keys For Service – Now Open to All Employment Types

Keys For Service, a down payment assistance program, is now open to ALL employment types. Get started with our team today!

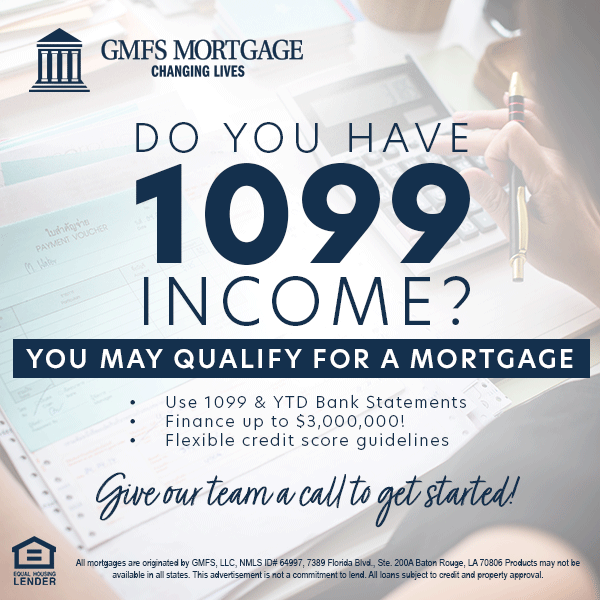

New guideline updates are making it easier for self-employed or 1099 income borrowers to get pre-qualified for their dream home!

Flexible Guidelines for Self-Employed Borrowers

Are you self-employed in Louisiana? GMFS Mortgage offers tailored loan options to help you secure the mortgage you deserve. Learn more today.

Exciting New Updates for Borrowers

New loan program updates are making it easier for qualified borrowers to purchase their dream home! Talk with a GMFS Mortgage Loan Officer

GMFS offers a loan program that can help ease the burden of a higher monthly payment, with help from your builder or independent seller.

Self-employed borrowers may benefit from bank statement mortgage. Instead of a W2, we use 1-to-2 years of bank statements